Sommaire

Rolex: A Coveted Prestige Investment Worldwide

Emblematic brand with unparalleled prestige. For over a century, Rolex has established itself as an absolute reference in luxury watchmaking. Owning a Rolex doesn’t just mean telling time: it means wearing a symbol of social success and timeless refinement. The brand’s reputation, built on impeccable quality and legendary innovations, gives its watches a unique aura of prestige. This aura means that today, many buyers see Rolex watches not only as timepieces but also as real financial assets. Indeed, some iconic models increase in value over time, making a Rolex “more than just a watch: a heritage asset”.

Global demand and skillfully maintained scarcity. The worldwide enthusiasm for Rolex is such that demand far exceeds supply for many models. The Geneva-based manufacturer produces about one million pieces per year, a significant figure but insufficient given the appetite of the international market. Aware that flooding the market could trivialize its products, Rolex has always been careful to control its production. This controlled scarcity helps maintain the desire of collectors: steel sports models, in particular, have become inaccessible in boutiques without a long wait. As one specialist summarizes, “Steel Submariners, and even more so GMT-Master IIs and Daytonas, remain the most difficult models to obtain, with demand far exceeding supply. Be patient.” Rolex prefers to forgo immediately satisfying all demand rather than compromise its quality standards or exclusivity. The result? Endless waiting lists at official retailers, soaring prices on the secondary market, and watches often trading well above their list price as soon as they are released.

Safe haven value and constant price increases. This situation of scarcity coupled with undisputed prestige has made certain Rolex watches an investment that is as passionate as it is reasonable. Historically, official prices increase by a few percent each year, and on the pre-owned market, highly coveted pieces see their value climb. Buying a collector’s Rolex today means not only treating yourself but also investing your money in a tangible asset whose value is highly likely to hold, if not increase. Thus, owning a sought-after Submariner or Daytona can be akin to possessing a watchmaking gold bar: a rare, liquid luxury good valued by time.

In this context, if you are considering buying a Rolex for investment purposes, you are making a coherent choice. However, it is necessary to select the most promising models for 2025 and know the best practices for a secure and sustainable purchase. This structured guide is aimed at enlightened enthusiasts wishing to take the plunge with full knowledge of the facts. We will review the flagship models to consider, their key characteristics and references, without forgetting exceptional vintage editions. We will also focus on the mythical yellow gold Day-Date, then provide practical advice for buying with peace of mind (authenticity, condition, complete set) and protecting yourself against counterfeits. The objective? To give you all the keys to invest wisely in a Rolex, in order to combine watchmaking passion and potential long-term appreciation.

Rolex Models with High Potential in 2025

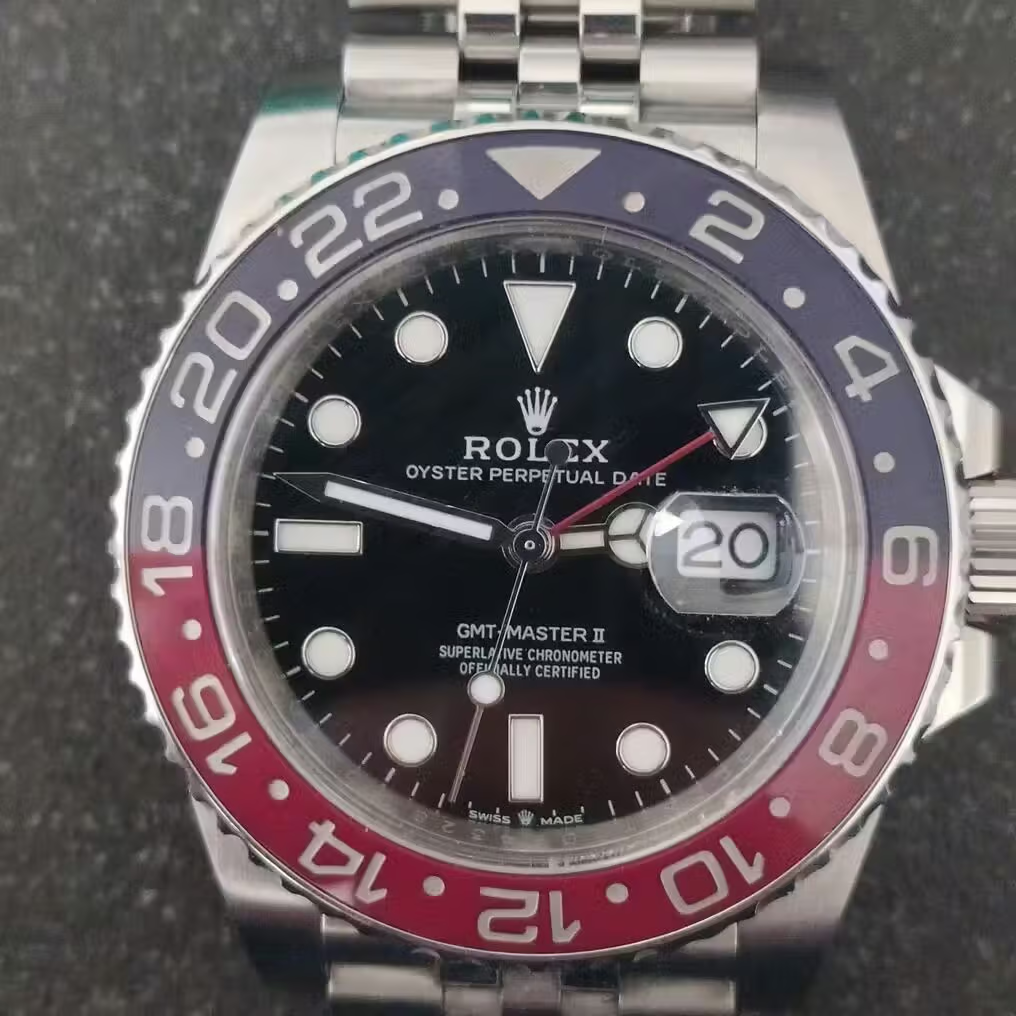

Rolex steel sports watches constitute the most sought-after segment by investors and collectors in 2025. These models combine foolproof robustness, legendary aesthetics, and measured production, fueling demand well above supply. We will focus on four essential sports icons: the Submariner (the diver’s watch par excellence), the Daytona (the mythical racing chronograph), the GMT-Master II (the traveler’s watch, here in its famous “Pepsi” version), and the Explorer I 36 mm (the mountaineering model returned to its historic format). Each of these Rolex watches presents strong appreciation potential, due to its universal appeal and calibrated production. Let’s discover in detail their specificities, the references to prioritize, and why they constitute excellent watchmaking investment choices.

Rolex Submariner: The Legendary Diver Still Highly Acclaimed

The Rolex Submariner, created in 1953, remains the most coveted dive watch in the world, synonymous with underwater adventure and timeless sporty style. In 2025, this emblematic model is at the top of investor searches. Its extreme popularity is explained by a perfect balance between iconic design – 60-minute graduated rotating bezel, black dial with luminescent indexes, Oyster case waterproof to 300 m – and controlled technical evolutions. For example, the Submariner adopted a robust bracelet with a Glidelock clasp and a scratch-resistant Cerachrom ceramic bezel in 2010, without ever betraying its original aesthetics.

References to prioritize: Two recent generations capture attention. On the one hand, the Submariner Date ref. 116610LN (produced from 2010 to 2020) – with its 40 mm case known as the “Super Case” – has already acquired collector status since its replacement.

On the other hand, the current version ref. 126610LN (introduced at the end of 2020) features a slightly enlarged 41 mm case and the new caliber 3235, while retaining the legendary overall look. The two references, in Oystersteel with black dial and bezel, are visually very similar; the 126610LN is distinguished by slimmer lugs and a power reserve increased to ~70h.

Their value on the grey market significantly exceeds the boutique price, testifying to the frenzy surrounding these models. For purists, the Submariner without date (No Date ref. 114060 then 124060) constitutes an equally prized alternative, thanks to its clean symmetrical dial and its direct link to the very first Submariner from 1953. The No Date version is sought after for its sobriety, although for investment purposes, most opt for the classic Date, which is more widely in demand.

Why is the Submariner a good investment? Its unshakeable status as the reference dive watch ensures constant demand. It’s an immediately recognizable model and highly liquid for resale. Furthermore, Rolex prudently adjusts its production, maintaining a relative level of scarcity in the market. Steel Submariners are difficult to obtain new (several years of waiting are common) and sell within minutes when a well-maintained pre-owned piece appears for sale.

This orchestrated scarcity maintains a virtuous cycle for owners: the value of Submariners holds remarkably well and has even seen notable increases in recent years due to speculation. As an example, a pre-owned 116610LN today trades above its new price from a few years ago, and the recent 126610LN sells immediately with a substantial premium on the secondary market. By choosing a modern Submariner in excellent condition, with box and papers, you are betting on a safe value whose worldwide fame offers real assurance of liquidity and appreciation over time. To illustrate this popularity, recall that a steel Submariner consistently tops online watch auction sales.

Its versatile style – sporty enough for diving but elegant enough to be worn daily with a suit – allows it to reach a very wide audience.

Whether for enjoying a high-end user experience or for its resale potential, the Submariner remains a preferred choice. Between a recent edition benefiting from the latest Rolex enhancements and a slightly older reference already unavailable new (thus potentially collectible), the investor has several possible strategies, each validated by the history of this cult model.

The Rolex Submariner is available here on Catawiki (discover a wide selection and exciting auctions)

Rolex Daytona: The Racing Chronograph at the Peak of Speculation

The Rolex Cosmograph Daytona is another centerpiece for anyone wishing to invest in a luxury watch. Launched in 1963 and dedicated to the world of motor racing circuits (it bears the name of the famous Daytona Beach circuit in Florida), it has become over the decades the reference chronograph in the world of sports luxury. The Daytona has acquired an almost mythical status, partly thanks to the actor Paul Newman whose personal model, a rare vintage reference, sold at auction for a record amount. In 2025, the modern steel Daytona (ref. 116500LN) remains one of the most sought-after watches on the horological planet, with closed waiting lists at official retailers and soaring pre-owned prices.

Key features and references: The current Daytona, reference 116500LN (produced from 2016 to 2023, recently replaced by the 126500LN in 2023 for the 60th anniversary), is distinguished by its black Cerachrom bezel and its high-precision automatic chronograph movement (Rolex caliber 4130). It is offered with a white or black dial, both variants being equally prized – the white dial version, known as “Panda,” having a slight popularity advantage among collectors.

This 40 mm watch in Oystersteel combines a sports chronograph (with a tachymetric scale engraved on the ceramic bezel for measuring speeds) and Rolex elegance, making it a timepiece as desirable on the track as in the office. Any steel Daytona on an Oyster bracelet is a modern Grail: Rolex produces relatively few each year, hence a chronic shortage facing exponential demand over the last 5 years.

From an investment perspective, the steel Daytona offers an exceptional appreciation profile. With access to new models being almost impossible for the average customer, the parallel market is booming: it is not uncommon to see a pre-owned 116500LN trading at double its original boutique price. This premium reflects the irrational appeal of this model, which has successfully created its legend (racing victories, famous ambassadors, unchanged design for decades). In the short term, acquiring a Daytona at a high price remains a winning bet as long as global demand remains insatiable. Even in the event of a slight market correction, the Daytona retains a very solid floor value thanks to its prestige. In the long term, its editions will undoubtedly be considered classics, and certain variants could become future collectibles (for example, the first examples from 2016 with certain dial particularities, or the 2023 anniversary models).

Why is the Daytona “unobtainable” in boutiques? Several factors explain this incredible tension surrounding this model. First, the difficulty in manufacturing the in-house chronograph caliber (the 4130) and Rolex’s desire to offer the steel Daytona only in limited volumes give each piece a form of exclusivity.

Second, the self-sustaining speculation: connoisseurs know that obtaining a Daytona is difficult, so everyone rushes for it, further accentuating the perceived rarity. Finally, the media cult surrounding this chronograph – regularly highlighted in record auction sales, worn by celebrities – arouses an almost irrational desire among collectors. Result: new Daytonas disappear as soon as they are delivered and fuel a flourishing parallel market. For an investor, getting hold of a Daytona (ideally full set, excellent condition) thus represents a prime investment opportunity, as the value of this model seems unsinkable.

Rolex GMT-Master II “Pepsi”: The Travel Watch with Iconic Colors

The Rolex GMT-Master II is another pillar of the Rolex sports range, particularly in its famous version with a two-tone red and blue bezel nicknamed “Pepsi”. Originally designed in 1955 for Pan Am pilots, the GMT-Master allows reading two time zones simultaneously thanks to its rotating 24-hour bezel and its additional GMT hand. The model evolved into the GMT-Master II in the 1980s but retained this emblematic Pepsi color code (blue for night hours, red for day hours). In 2025, the GMT-Master II ref. 126710BLRO, which is the current steel version with a Pepsi bezel, is among the most in-demand watches on the market, almost as sought-after as a Submariner or a Daytona.

Features of the 126710BLRO (Pepsi): Introduced in 2018, this reference marked the grand return of the red-blue bezel in steel (after a decade of absence where only white gold models sported these colors). It is distinguished by its exclusive two-tone Cerachrom bezel – a technical feat by Rolex – and is offered on a Jubilé bracelet (5-link chain) for a neo-vintage look, and more recently also on Oyster. Its 40 mm Oystersteel case houses the new generation caliber 3285, guaranteeing about 70 hours of power reserve.

The black dial, the Cyclops lens over the date, and the GMT hand with a red triangle complete the familiar aesthetic. The nickname “Pepsi” has become inseparable from this model, to the point that it is one of the most recognizable Rolex watches at first glance.

Investment attractiveness: The GMT-Master II Pepsi presents a similar profile to the Submariner Date in terms of appreciation – and even superior in some aspects, due to its relative novelty and immediate craze. From its launch, demand was staggering: waiting lists at Rolex were full for years, and the parallel market saw prices soar to more than double the official price. This dynamic continues in 2025, driven by the retro charm of the Pepsi bezel and the versatility of the GMT function, highly prized by travelers and international business people. Like other steel sports watches, the production of GMT-Master II is limited, and the examples put up for sale sell out very quickly.

An investor who manages to acquire a complete 126710BLRO in perfect condition can be confident about the stability of its value: it is a model that is both highly utilitarian and highly collected, so demand is structurally high. Furthermore, the glorious history of the GMT (which became the favorite watch of countless pilots, adventurers, and even astronauts) gives it an extra soul appreciated by the public. The Pepsi model, in particular, echoes the first GMTs of the 1950s worn by exceptional personalities.

This historical aura, combined with modern technical improvements, makes it a wise choice for combining watchmaking pleasure and investment. Finally, Rolex has expanded the GMT range with other colors (black-blue bezel “Batman/Batgirl”, brown-black “Root Beer” on Rolesor, etc.), but the steel Pepsi version remains the most iconic and the most secure in terms of value. It is therefore naturally the one favored by savvy investors.

Rolex Explorer I 36 mm: The Return to the Roots of a Timeless Classic

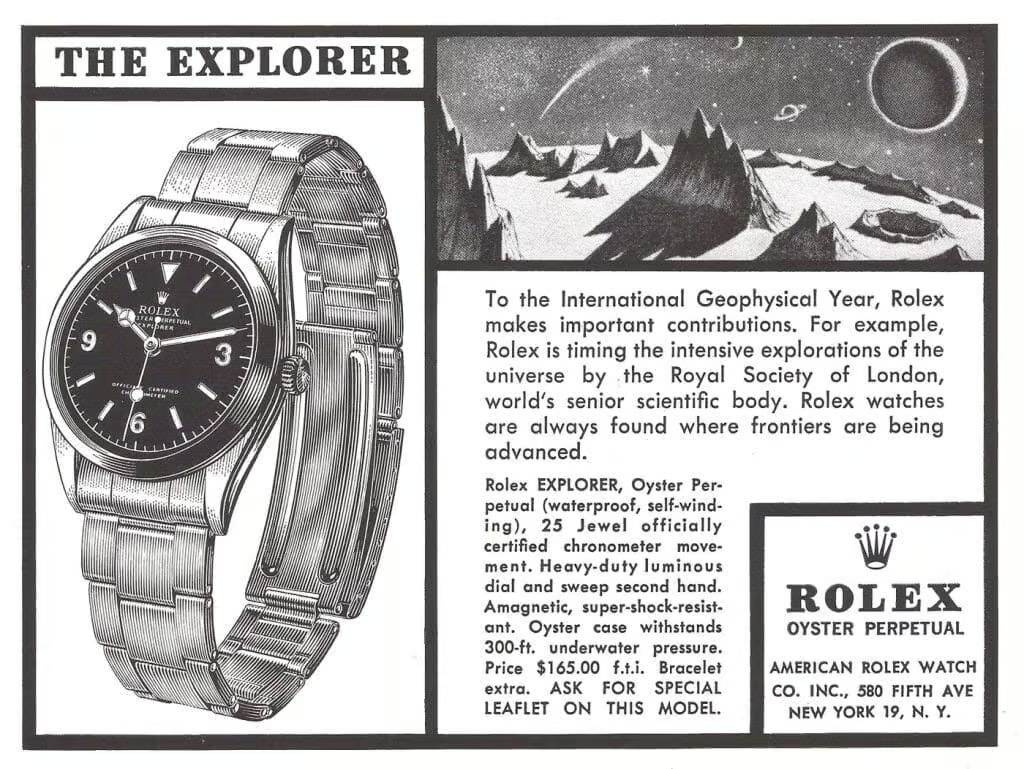

The Rolex Explorer I is a distinct model in the range: less ostentatious, more refined, it represents the sober spirit of adventure dear to the brand. Launched in 1953 after the ascent of Everest (for which Rolex was a partner), the Explorer is a three-hand watch without a date, initially 36 mm in diameter, designed for extreme legibility and robustness in hostile conditions.

In 2021, Rolex had the happy idea of returning to this historic 36 mm diameter (after having increased it to 39 mm for a decade), thus reviving the model’s appeal among purists. The current Explorer ref. 124270 therefore adopts the original format, much to the delight of collectors, and establishes itself in 2025 as a piece with strong potential for those seeking a more discreet but equally prestigious sport-chic Rolex.

Features and appeal of the 36 mm model: The new Explorer 124270 (Oystersteel) sports a black lacquered dial with iconic 3-6-9 numerals and indexes, with blue Chromalight illumination ensuring night-time readability. Its 36 mm case, waterproof to 100 m, is powered by the latest generation caliber 3230. The design is as classic as it gets at Rolex – the same aesthetic has been found for nearly 70 years – which gives this watch absolute timelessness. The decision to return to 36 mm was very positively received: this diameter suits both men who appreciate understated watches and a female clientele attracted to characterful sports watches. Thus, the Explorer I 36 mm reaches a wide audience, and its distribution remains relatively limited (it is a model produced in smaller quantities than Submariners or GMTs). This creates demand exceeding supply in some markets. Without reaching the extreme speculation of the Daytonas, the new Explorer has seen its value gradually rise since its release, especially for complete examples in perfect condition.

Why bet on the Explorer I? Firstly, because it embodies the longevity of Rolex design: buying an Explorer today means owning a watch that will still be elegant in 30 years, and whose value will not be diluted by fleeting trends. Secondly, because this model remains relatively affordable in the Rolex universe, while sharing the same manufacturing quality and renowned emblem. The

Explorer is often recommended as a first luxury Rolex, including in our article “First Luxury Watch – Top 5” where Rolex features prominently. As such, many enthusiasts who covet it already intend to purchase it, ensuring decent liquidity should you decide to resell.

Finally, its glorious history (watch associated with Himalayan exploits and extreme resistance) gives it strong symbolic value. For an investment, betting on the Explorer 36 mm means banking on a timeless classic, whose relative rarity and understated elegance could well attract more and more buyers in the future – especially those put off by the soaring prices of Submariners/Daytonas, who will turn to more underestimated models like the Explorer.

The Rolex Explorer is available here on Catawiki (browse exclusive offers and bid on rare pieces)

What About Vintage Models? The Appeal of Iconic Collector’s Rolexes

Besides contemporary references, some rare vintage Rolex watches reach unparalleled heights in terms of value and symbolic prestige. The figurehead is undoubtedly the “Paul Newman” Daytona, named after the American actor whose famous exotic dial was long shunned before becoming extremely sought after.

These Daytonas from the 1960s-70s with contrasting sub-dials (ref. 6239, 6241, etc.), produced in limited quantities, sell today for hundreds of thousands of euros, or even more for examples with exceptional provenance.

Investing in such pieces, however, is more akin to a treasure hunt than a reasoned purchase: access is difficult (few offers on the market, possible counterfeits), and prices are very volatile. Nevertheless, owning one of these iconic vintage Rolexes – whether it’s a “Big Crown” Submariner from the 50s, a 1955 bakelite “Pepsi” GMT, or of course a Paul Newman Daytona – confers a special status within the collector community.

For most investors, it is probably wiser to focus on recent models in excellent condition. This does not prevent appreciating the historical value and the staggering symbolic worth of these legendary watches (we dedicate a special article to vintage Rolexes, by the way). While they may be out of reach for a typical investment, they remind us how well the brand knows how to create watchmaking myths whose fascination endures through time.

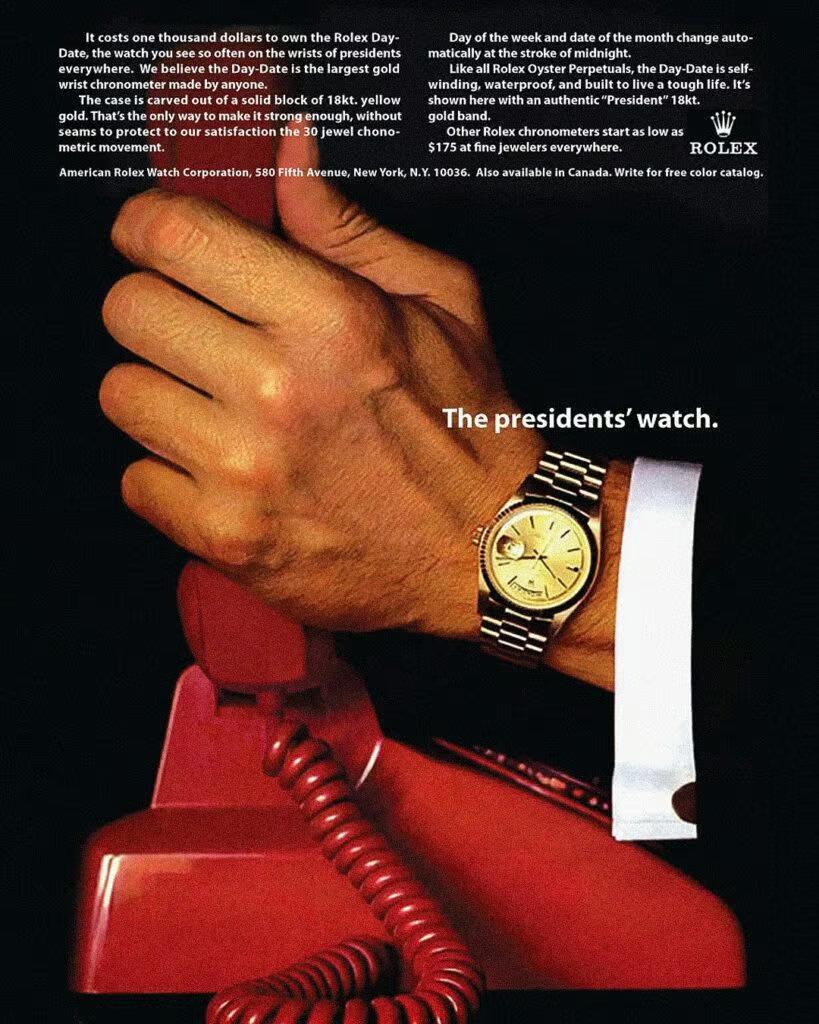

Focus: The Yellow Gold Rolex Day-Date, A Glitzy Icon with a Golden Destiny

Among luxury Rolexes, the yellow gold Day-Date, nicknamed the “President,” deserves special mention. Introduced in 1956, this prestigious watch was the first to display the day of the week spelled out in full in addition to the date, and it is made only in precious metals (18 ct gold or platinum). A symbol of power and success, it has adorned the wrists of numerous heads of state, businessmen, and personalities worldwide. In 18-carat yellow gold on a President bracelet, with its dial proudly displaying the date and day (available in 26 languages), the Day-Date embodies ostentatious luxury in all its splendor.

A watch prized by specific clienteles.

Traditionally, the yellow gold Day-Date is particularly appreciated in certain cultures where gold is an outward sign of wealth. In Russia especially – but also in many emerging countries in Asia or the Middle East – this all-gold Rolex is a true object of desire. Its flashy shine and imposing weight appeal to a clientele that sees precious metal as a secure value and a marker of social status. In the 1980s-90s, the yellow gold Day-Date was almost a uniform among the elites of certain nations, which still gives it a slightly “ostentatious” image today. However, mentalities are evolving, and there is a renewed interest in these vintage gold models, which exude retro charm and an assertive statement.

Valuation and link to the price of gold.

From an investment perspective, the yellow gold Day-Date has a unique characteristic: its base value is intrinsically linked to the price of gold. Indeed, as the watch contains a significant amount of precious metal, it constitutes a value floor (its “melt value,” if we dared) below which the watch will not fall, barring a collapse in gold prices.

Thus, during periods of rising commodity prices, owning a Day-Date is partially akin to holding gold, and its market price will tend to follow the upward trend of the metal. That said, beyond this component, the Day-Date remains above all a collector’s item: recent versions (Day-Date 36 ref. 128238 or Day-Date 40 ref. 228238) maintain a stable value on the secondary market, without particular surges, because Rolex produces enough examples to satisfy demand (unlike steel sports models).

Vintage versions or those featuring rare options (diamond-paved dials, limited series, etc.) can, however, achieve higher valuations.

In short, investing in a yellow gold Rolex Day-Date is more about hedonistic and patrimonial pleasure than rapid speculation. It’s a watch bought to stand out, to feel the weight of gold on the wrist and the historical prestige it represents (after all, every US president since Lyndon Johnson has worn one, hence its nickname). Its potential for financial gain exists, but it is moderate and conditional on gold fluctuations. On the other hand, its potential for personal satisfaction and social distinction is very real. For those who identify with this assertive ostentatious style, a yellow gold Day-Date is an achievement. And if you resell it, you will easily find buyers, especially in markets where this model is a dream. In summary, a gold Day-Date is a less speculative bet than steel models, but an undeniable heritage piece, to be considered more as a pleasure investment indexed to gold.

Practical Tips for a Successful Rolex Purchase

Buying a Rolex for investment purposes requires caution and discernment. Here are some practical recommendations to maximize your chances of making a good deal and avoiding disappointments:

Prioritize “full set” examples: The value of a Rolex will always be higher if the watch is sold with its original box, outer box, manual, and especially its named warranty certificate. A “full set” model reassures the next buyer about the authenticity and history of the watch, and often allows for an easier and more expensive resale. Conversely, a watch without papers or box sees its value decrease. To invest with peace of mind, target sellers offering complete lots as much as possible.

Examine the condition carefully: Prioritize watches in excellent original condition, having undergone only necessary maintenance. Beware of overly polished pieces: excessive polishing of the case or bracelet can round the edges and cause material loss, altering the original geometry – and thus the collector’s value. Likewise, verify that the dial, hands, and bezel are original Rolex and consistent with the reference and year. Unofficial or non-compliant replacement components decrease the value (except for prized “tropical dials” despite their defect). Sometimes an authentic micro-scratch is better than a non-compliant refurbished watch.

Choose popular and liquid references: From an investment perspective, it might be tempting to turn to cheaper or lesser-known models in the Rolex range. However, resale will be all the more uncertain. It is generally advisable to focus on the brand’s iconic references, those that benefit from solid and international demand. For example, if your budget allows, opt for a classic Submariner Date rather than a marginal variant. Similarly, a GMT-Master II Pepsi or Batman will be easier to resell than a less universal Milgauss or Air-King.

In short, prioritize the undisputed icons (Submariner No Date or Date, steel Daytona, GMT Pepsi/Batman, Explorer, Datejust 41…), as they are the ones that best retain their value thanks to a large base of potential buyers.

Research the value and the market: Before any purchase, consult recent sales results and current listings for the reference that interests you. Prices can vary significantly depending on the year, condition, and accessories provided. Having a good overview of the market price will prevent you from overpaying. Specialized online auction platforms, like Catawiki, provide a history of adjudications that can serve as a reference. Do not hesitate to consult experts or browse enthusiast forums (RolexForums, Chrono24, etc.) to gather opinions. A forewarned investor is worth two!

Buy from trusted sellers: This may seem obvious, but it is crucial to turn to reliable sources. Ideally, go through an official Rolex retailer (for new, in the rare case of immediate availability) or through a recognized platform that offers authenticity guarantees and an expertise procedure like Catawiki. Avoid anonymous sellers with no history, or offers that are too good to be true. For a valuable pre-owned Rolex, it is often better to pay a slight premium to a reputable establishment than to risk a bad surprise by seeking the lowest price.

By following these tips, you will significantly increase your chances of making a safe and satisfying investment. A well-chosen and well-purchased Rolex can then be kept for a few years with pleasure, then resold under good conditions if that is your plan.

Protecting Yourself Against Counterfeits: How to Spot a Fake Rolex

The global success of Rolex unfortunately has the corollary of a plague of counterfeits flooding the market. Fakes of highly variable quality circulate, from crude quartz imitations sold for a few tens of euros to sophisticated “superfakes” that are difficult to detect even by trained eyes. For the investor, unintentionally buying a fake Rolex would obviously be catastrophic. It is therefore essential to know the distinctive signs that betray a counterfeit, and to remain vigilant during any transaction. Here are the main check points:

Weight and perceived quality: An authentic Rolex always gives an impression of solidity and density when held. High-end materials (Oystersteel 904L, solid 18 ct gold) give it a substantial weight.

“If a Rolex feels unusually light, it is often the first sign of an imitation.” Fake watches use lower density alloys or hollow bracelets, which is immediately noticeable. Likewise, the overall finish (case edges, link articulation, feel of the winding crown) must inspire confidence – any feeling of excessive play or mechanical fragility should raise alarm.

The Cyclops lens over the date: This is an emblematic feature of Rolex date models. On a real Rolex, the sapphire crystal incorporates a domed lens (Cyclops) magnifying the date 2.5×, making the numbers clearly legible.

Many fakes feature a dummy lens with lesser magnification (1.5× or 2×) – the date then appears strangely small. Furthermore, the quality of the lens is lower: approximate alignment, flat surface, annoying reflections. An authentic Rolex Cyclops is perfectly centered over the date window and offers clear reading. If the date numerals appear too small or blurry under the lens, be wary.

Engraved serial and model numbers: Every Rolex bears fine and precise engravings of its serial number and reference. On modern productions, these engravings are located on the inner rehaut (the flange around the dial, under the crystal) at 6 o’clock for the serial number, and “ROLEX ROLEX…” all around. Counterfeiters sometimes struggle to reproduce the laser quality of these inscriptions: on a real Rolex, they sparkle in the light like diamond cuts and the letters/numbers are perfectly formed.

Furthermore, fakes tend to reuse the same serial numbers on several different watches (lacking the ability to generate unique codes). Therefore, check that the serial number matches the papers and is unique. An online search of the number can sometimes reveal if it is identified as fake (some numbers often appear in imitations).

The case back: Apart from very rare historical exceptions, Rolex does not use transparent case backs on its watches. A sapphire case back revealing the movement is almost certainly a sign of a fake Rolex. Moreover, real Rolex case backs are generally smooth, without external engraving (except for some inscriptions on older models or certain limited editions). Copies sometimes feature fanciful logos or inscriptions on the back. In summary, if you see a Rolex with a strangely engraved back or a glass back, alarm bells should ring.

The movement and the second hand: Observing the movement is not always possible (non-transparent case back), but one can listen to and watch the second hand. An authentic automatic Rolex has a smooth sweeping second hand (about eight beats per second, giving the illusion of continuous glide). On low-end quartz fakes, the second hand ticks distinctly once per second. Some high-end fakes, however, use Asian automatic movements that mimic the sweep; the absence of a tick-tock is therefore not a sufficient guarantee of authenticity. Conversely, the appearance of the movement can betray a fake if the case can be opened: a genuine Rolex caliber is a jewel of engineering, with careful finishes, a “Rolex” engraving on the rotor, etc., whereas a fake will exhibit a generic movement without embellishments.

Dial details and markings: The perfection of the Rolex dial is difficult to copy 100%. Scrutinize the dial inscriptions (“SUPERLATIVE CHRONOMETER OFFICIALLY CERTIFIED,” for example): on a genuine one, they are sharp, regular, and without smudging even under high magnification. Fakes may exhibit slight flaws: incorrect font, letters too thick or misaligned, crooked luminescent index, etc. Similarly, the bezel engravings (numerals on the Cerachrom bezel, for example) must be impeccable.

Finally, keep in mind that buying from a reliable professional remains the best defense against counterfeits. Expert platforms like Catawiki, which have each watch physically examined by specialists before sale, offer valuable security for the buyer. If in doubt, do not hesitate to have the watch authenticated by an official Rolex watchmaker afterward: it is better to discover fraud immediately (and assert legal guarantees for reimbursement) than to realize it years later. Vigilance is key, as counterfeiters constantly improve their copies. But by applying the checks above and trusting your common sense (abnormally low price, hurried seller, vague provenance = danger), you will avoid most pitfalls. Buying a Rolex should remain a pleasure and a source of pride, not a worrying puzzle; therefore, surround yourself with the right protections to enjoy it with peace of mind.

Conclusion: Combining Reason and Passion for a Winning Investment

Investing in a Rolex watch means choosing safe value and timeless refinement. Whether it’s a timeless Submariner, a coveted Daytona, an emblematic GMT-Master II, or a sober Explorer, each model from the green crown tells a story of success and carries within it a potential for appreciation linked to its rarity and prestige. In 2025, as financial markets are volatile, owning a collector’s Rolex can appear as a tangible way to diversify one’s assets while treating oneself. However, as with any investment, prudence and knowledge are required.

We have seen that it is advisable to select the right model according to demand, scrupulously verify authenticity and condition, and stay informed about market trends. By following these recommendations, you will put all the chances on your side for your watch acquisition to prove fruitful in the long term.

Let’s also not forget that a Rolex is an object that can be worn and admired daily – a living investment, in a way. It provides immediate satisfaction, an aesthetic and mechanical emotion that few other investments can offer. This is the whole magic of luxury watchmaking: combining the useful with the pleasant, reason with passion.

Ultimately, whether you consider this purchase as a first step into the world of prestige watches (in which case consult our selection of the best first luxury watches, where Rolex naturally features) or as a strategic addition to an already established collection, a well-chosen Rolex will stand the test of time, preserving its brilliance and value. Take the time to reflect, surround yourself with informed advice, then let yourself be guided by the irresistible attraction exerted by the Rolex crown. You will thus join the long line of enthusiasts who have made these watches much more than mere timepieces: true legends to wear on the wrist, and a heritage to pass on. Good watchmaking investment – and above all, enjoy your journey into the Rolex universe, where every tick-tock resonates with history and every watch carries within it a part of a dream.

End of article- サントス・ガルベXL:静かに60%も上昇したカルティエの隠れ名作 - 26/07/2025

- 卡地亞 Santos Galbée XL:悄悄升值60%,你錯過了嗎? - 26/07/2025

- 卡地亚 Santos Galbée XL:5年涨幅60%,你注意到了吗? - 26/07/2025