With the volatility of financial markets and economic uncertainty, more and more investors are turning to tangible and alternative assets. Luxury watchmaking, long considered merely an aesthetic pleasure or a status symbol, is now establishing itself as a prized alternative investment. Are luxury watches – whether rare vintage pieces or highly sought-after contemporary models – becoming a new safe haven for protecting one’s wealth?

This in-depth article, supported by figures, assesses the strengths and limitations of such an investment, and recommends some essential « blue chip » watch models on the secondary market.

Sommaire

A Tangible Asset with Unique Advantages

Investing in a luxury watch isn’t just about speculating on its future value: it’s also about acquiring an exceptional object that you can see, touch, and wear. Unlike dematerialized financial assets, watches are very real material goods. Like gold bars, diamonds, or works of art, they offer the psychological security of owning something concrete with intrinsic value. Indeed, owning a Rolex, a Patek Philippe, or an Audemars Piguet is akin for some to building lasting wealth, comparable to investing in gold or real estate. This tangible dimension is reassuring in times of crisis: one knows that the watch can neither go bankrupt nor drop to zero, and that it can eventually be resold.

Portability and Discretion: Wealth on the Wrist

A major advantage of luxury watches is their extraordinary portability. A few centimeters in diameter and a few grams of precious metal can concentrate five or six-figure sums. This makes them one of the most effective ways to transport value discreetly. It is much easier to slip a collector’s watch onto your wrist or into a small safe than to move the equivalent in gold bars or master paintings. If necessary, these timepieces can accompany you anywhere in the world without attracting attention.

As one expert pointed out, « in a worst-case scenario, luxury watches – unlike art, cars, or wine – are portable and durable assets. » In other words, they embody mobile wealth that is easily transferable, far from the radar of traditional markets and regulators.

Partial Decoupling from Financial Markets

Beyond the physical aspect, the interest in a luxury watch as an investment lies in its relative decoupling from traditional stock market assets. The watch market follows its own dynamics of rarity, collector demand, and aesthetic trends. It has sometimes evolved out of sync with stock market indices: a crash or boom in stocks does not necessarily impact the prices of collector models.

Indeed, collector’s watches generally show low, or even negative, correlation with stocks and bonds. In other words, the rise or fall of the stock market has little – if any – influence on the value of certain sought-after watch references. During financial crises, there has even been a shift of investors towards these alternative safe-haven assets.

For example, in the midst of the 2020 pandemic, as stock markets faltered, a veritable rush for watches occurred: models like the Patek Philippe Nautilus or the Rolex Daytona saw their prices soar by +200% on the secondary market in just a few months. This phenomenon is explained by the search for stability and confidence in historic brands that control their production.

It should be noted, however: watches are not totally immune to corrections. After the excessive speculation of 2021, a bubble partially deflated in 2022, with adjustments of -20 to -30% on certain contemporary references. Nevertheless, over the long term, the general trend remains upward.

The global luxury watch market is valued at tens of billions of euros and continues to grow by about 5 to 10% per year. Above all, vintage or limited-edition pieces show impressive performance. Some out-of-production watches have seen their value multiply by three, four, or even more, proof that their return on investment (ROI) can compete with traditional investments.

Aesthetic and Emotional Pleasure

Unlike a gold bar locked in a safe, a luxury watch provides daily pleasure of use and admiration. It is an investment that one can proudly wear on the wrist, visually appreciate, and pass down as an inheritance. The major Swiss manufacturers design each timepiece as a mechanical work of art: hand-finishing, sophisticated watchmaking complications, iconic design…

Owning a beautiful watch also means treating oneself to a piece of this dream, with the emotional satisfaction of owning an exceptional object. This passionate dimension is not insignificant in the purchase decision: many collectors cite « aesthetic and sentimental pleasure » to justify a substantial budget. In this sense, watch investment is what is called a passion investment.

It combines reason and heart: one hopes for future capital gains, but already enjoys the watch here and now. This is an intangible advantage compared to stocks or cryptocurrencies, which remain soulless lines of code. Owning a Patek Philippe or a vintage Rolex also confers a certain social prestige, much like driving a classic car: one asserts one’s taste and shares a piece of watchmaking history.

Rising Valuations: Figures and Iconic Models

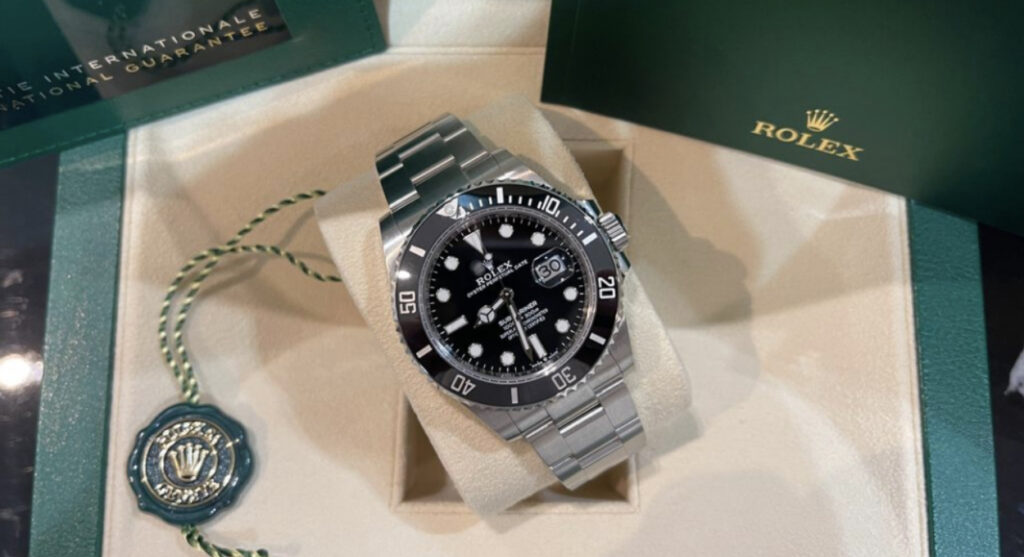

The Rolex Submariner Date, shown here in a classic steel version with a black bezel, is one of the most prized sport-chic models in the world. Its cult references, especially vintage ones, have seen their prices soar spectacularly on the secondary market.

Beyond principles, market figures confirm the interest in luxury watches as a safe haven. Many iconic models have rapidly gained value in recent years. A few examples illustrate this trend:

- Rolex Daytona: A legendary chronograph associated with Paul Newman, the steel Daytona sold new for around €12,000 a few years ago. On the grey market, its price exploded during the health crisis. In March 2022, a modern Daytona traded for up to €45,000 – an extraordinary amount for a steel watch.

After the late 2022 correction, they can be found second-hand for around €36,000, which is still three times the original boutique price. Vintage versions command even more stratospheric prices: Daytonas from the 1970s, once shunned, have become million-dollar collector’s items for some extremely rare references.

The Rolex Daytona is available here on Catawiki (many rare models and great auction opportunities)

- Patek Philippe Nautilus 5711: Considered the holy grail of luxury sports watches, production of this steel Nautilus designed by Gérald Genta was halted in 2021. Consequence: its value skyrocketed. Its price on the secondary market peaked at around €190,000 in 2021, whereas it cost about €30,000 in boutiques. Even after an adjustment, the Nautilus 5711 was still trading near €150,000 at the end of 2022. A particular example with a Tiffany blue dial even sold at auction for over $6 million, proof of the speculative frenzy surrounding this mythical model. For comparison, its ancestor, the Nautilus 3700, cost €9,300 in the 1970s and is worth over €145,000 today – a performance of +2100% over the long term.

- Audemars Piguet Royal Oak Jumbo: Another Gérald Genta creation, the Royal Oak « Jumbo » reference 15202 in steel is an iconic model introduced in 1972. Highly sought after by collectors, its price literally soared in the 2010s-2020s. An example bought for around €35,000 in 2010 is worth more than 2.5 times that amount on the current market. In March 2022, before its production stopped, its price reached nearly €140,000 for new pieces, before falling back to around €110,000 a few months later. Even second-hand, a Royal Oak « Jumbo » in excellent condition remains an investment of over €70,000, with strong prospects for future appreciation given the end of its production. Limited editions in gold or platinum trade at six-figure prices.

Other notable examples: the Rolex Submariner, an iconic diving watch, has seen certain vintage references (like the Submariner 14060 or 5513) become cult items and gain significant value. The sporty Rolex GMT-Master II « Pepsi » or the Submariner « Hulk » experienced significant premiums on the grey market. The Girard-Perregaux Laureato, long underestimated, doubled in price between 2021 and 2022 (from €8,000 to €18,000). Generally, the second-hand luxury watch market showed growth of around +10% in 2022 despite economic turbulence. Vintage models, in particular, are experiencing a strong resurgence of interest and seeing their prices hold or even increase, while some highly speculative modern references have undergone a welcome normalization.

Risks and Limitations of Watch Investment

Faced with these enticing performances, however, it must be kept in mind that collecting watches involves risks and limitations. Like any investment, there is no guarantee that the value curve will always be upward – and some disappointments are possible if one is not sufficiently informed. Here are the main constraints to consider:

- Limited Liquidity: Unlike a stock or cryptocurrency that can be sold in a few clicks at any time, reselling a luxury watch can take time. The secondary watch market is less liquid than traditional financial markets. It often requires going through specialized platforms, auction houses, or professional dealers, which involves delays and fees. Finding a buyer at the desired price may require patience and expertise. In case of urgent need for cash, a watch is not the most easily negotiable asset, especially if it is a very high-end model with a narrow potential buyer base.

- Risk of Theft or Loss: Paradoxically, what makes the strength of the watch (its small size and discretion) also constitutes its danger. Wearing a high-value piece exposes one to covetousness. Thefts of luxury watches have multiplied in major cities in recent years, targeting trendy models. A second of inattention can lead to the disappearance of your precious timepiece. Furthermore, a watch can be lost, damaged, or suffer an accident. It is therefore strongly advised to insure expensive pieces and take precautions (secure safe, vigilance when wearing in public, etc.). This risk of loss or theft, non-existent with an intangible asset, must be factored into the calculation of the real return.

- Choosing the Right Model: Not all luxury watches automatically increase in value, far from it. The market is very selective. The most sought-after references (often steel sports models from major Swiss brands, or limited editions) tend to appreciate well. Conversely, more common watches, editions with too wide a circulation, or less established brands can depreciate over time. For example, many mid-range or fashion models lose value as soon as they are bought new, just as a car loses part of its value after leaving the dealership. Only certain « cult » pieces benefit from speculation and constant collector demand. It is therefore crucial to do research, identify market trends, and prioritize the safe values of watchmaking. Investing in the wrong reference, or at the wrong price, can lead to zero or even negative returns. As one specialist recalls: « Only a handful of watches generate high returns, many others do not find buyers at the expected prices. » In short, it is better to be selective and have good knowledge of the field – or seek advice from experts.

« Blue Chip » Watches to Prioritize

In collector’s jargon, certain iconic watches are described as watchmaking « blue chips »: they are safe values, whose prices are historically stable or increasing, and for which demand remains strong on the secondary market. Without constituting infallible purchasing advice, here are three models renowned for their investment solidity:

- Rolex Submariner Date: The Submariner has been the reference diving watch since 1953. An iconic version from Rolex, it combines robustness and sporty elegance. Its variations, particularly the Submariner Date with a date window, are highly sought after by enthusiasts. It is an easy piece to resell thanks to Rolex’s global reputation and constant demand. As its design has changed very little, both vintage and recent models retain a high value.

- Patek Philippe Nautilus 5711: Having become a true symbol of success, the steel Nautilus 5711 is one of the most coveted watches in the world. Its production halt has made the object even more desirable, creating artificial scarcity. On the second-hand market, its value has soared beyond all rationality in recent years, making it quite speculative. Nevertheless, as Patek Philippe is synonymous with excellence and limited production, the 5711 remains a watchmaking safe haven for those who can afford it.

- Audemars Piguet Royal Oak « Jumbo »: The first luxury steel watch to shake up the industry, the Royal Oak designed by Genta is a pillar of high watchmaking. The Extra-Thin « Jumbo » version (ref. 15202) of 39 mm is particularly prized for its direct link to the original 1972 model. Its recently halted production has already caused its price to rise, and collectors worldwide are clamoring for the last examples. It is a connoisseur’s choice, whose rarity and prestige ensure lasting appeal on the secondary market.

These models are, of course, not the only potentially interesting ones, but they constitute a solid starting point for those wishing to invest prudently. Other timepieces, such as the Rolex Datejust, the Omega Speedmaster « Moonwatch, » or the Jaeger-LeCoultre Reverso, are frequently cited among the stable values of collectible watchmaking.

In Summary: A Passion Investment, Handle with Care

In conclusion, luxury watches can indeed be likened to a new safe haven in a diversified portfolio. They combine the advantages of a tangible, portable asset partially decoupled from financial markets, while offering the unique pleasure of owning a functional work of art. The notable performance of some models (value multiplied by 2, 3, or more over a decade) shows that a well-thought-out watch investment can compete with traditional investments, and even outperform them in some cases.

In times of inflation or instability, keeping a portion of one’s wealth in rare watches can therefore be wise to diversify risks. However, it is important to remain clear-headed and measured. This niche market experiences cycles, hypes, and corrections. Not all timepieces gain value, and liquidity is not guaranteed.

For those willing to do their research, rigorously select pieces, and consider a medium to long-term investment horizon, investing in a luxury watch can be both an enriching and exhilarating adventure. At the crossroads of finance and passion, the well-chosen luxury watch can thus fulfill a dual role: a refuge for your capital and a watchmaking jewel on your wrist. As always, prudence and knowledge are your best allies in turning this fascination with time into a true asset.

- 标题:终极指南:2025 年最佳男士皮夹克品牌:我们的精选 - 18/04/2025

- 標題:終極指南:2025年最佳男裝皮褸品牌:我哋嘅精選 - 18/04/2025

- Назва: Повний гід: Найкращі бренди чоловічих шкіряних курток 2025: Наш вибір - 18/04/2025