Sommaire

Pre-Ceramic Rolex Watches (1988-2009): Models with the Highest Latent Upside in 2025

While all eyes are on the latest ceramic Rolexes, a generation of watches seems to have slipped under investors’ radar. These “in-between” models, produced from 1988 to 2009, hide an appreciation potential that few still suspect in 2025.

Forget everything you’ve been told about “recent” Rolex watches having no collection value.

Do you think investing in Rolex means choosing between vintage pieces from the 60s-70s (already overpriced) or contemporary ceramic models (overvalued)? Think again. There is a third, largely overlooked path: pre-ceramic Rolexes.

These watches, produced approximately between 1988 and 2009, present a fascinating paradox. They incorporate the technical innovations of the late 20th century. But they retain the soul of yesteryear’s tool watches. Aluminum bezels, drilled lugs, proven calibers: so many details that Rolex has since abandoned.

The result? An often spectacular latent appreciation margin. While collectors fight over six-figure Paul Newman Daytonas, some pre-ceramic references have quietly doubled in value since 2013. And this is likely just the beginning.

In this analysis, we dissect eight models whose appreciation potential remains largely underestimated. Ready to discover tomorrow’s hidden gems?

A range of Rolex sports watches displayed in a shop window, including iconic pre-ceramic models with their prices (in Euros).

“Pre-ceramic” Rolex sports watches – produced approximately between 1988 and 2009 – are generating particular excitement among collectors in 2025. These references, predating the adoption of ceramic bezels, are distinguished by a often very high latent value margin: in plain terms, their current price remains below the value anticipated by experts. In this article, written in a professional yet personal tone, we will explore the historical and technical reasons for this enthusiasm, the valuation method used, and we will review the 8 main models to watch. Illustrations, multi-currency comparison tables, and graphs will help you visualize the evolution of their prices, while a dedicated section will highlight the key criteria (such as Flat Four, Pepsi, SEL, drilled lugs, punch papers…) to know before buying. Finally, we will conclude with a purchase and authentication checklist to secure your investment in one of these pre-ceramic Rolexes.

Historical Context and Characteristics of Pre-Ceramic Rolexes

Pre-ceramic Rolexes essentially correspond to sports references with an aluminum bezel produced from the late 1980s until the gradual adoption of Cerachrom (ceramic) bezels from 2005-2008. This period saw significant innovations coexist while maintaining a traditional design. For example, Rolex used tritium luminescent material until around 1998 (TSwissT 25 inscription on the dial), then switched to Luminova and Super-Luminova from ~1998-2000, eliminating the issue of radioactive patina. Similarly, drilled lugs (through-holes in the case lugs to facilitate strap changes) began to disappear in the early 2000s in favor of solid lugs for a sleeker look. Rolex also improved its Oyster bracelets during this era: SEL (Solid End Links) appeared on some references around 2000, replacing folded end links and providing increased bracelet strength. Concurrently, the legendary caliber 3135 (automatic movement with date) equipped most models from 1988, offering reliability and precision. Finally, Rolex began engraving the inner rehaut of the case (with the text “Rolex Rolex Rolex” and the serial number) from the mid-2000s on certain references, an authenticity detail now sought after on these transitional pieces.

In short, pre-ceramic models represent a historical turning point: they combine classic proportions (cases ~40 mm without excessive thickness) and features on their way out (tritium, drilled lugs, aluminum inserts with sometimes unique colors) while benefiting from significant technical improvements from the late 20th century. These specificities now give these watches a nostalgic aura and growing desirability, especially since every configuration detail (dial type, bezel style, SEL bracelet or not, etc.) can strongly influence their value in the eyes of discerning collectors.

Latent Upside Valuation Methodology

To identify pre-ceramic Rolexes with the highest latent upside in 2025, we cross-referenced several sources and valuation criteria. On one hand, we analyzed market data from specialized platforms such as WatchCharts, Subdial, and Chrono24 listings to obtain current and past average prices (notably values from 2013 and 2025) for each reference. On the other hand, we selected models whose current price remains ≤ €15,000 approximately (to focus on financially accessible pieces) and which show a significant gap with the anticipated value considering trends. The price difference between 2013 and 2025 allowed us to calculate a Compound Annual Growth Rate (CAGR) for each watch, a quantitative indicator of its price progression. Finally, we considered the liquidity of each reference, i.e., the ease and speed with which it can be resold on the current market (volume of listings, average selling time, popularity among collectors).

Example of a shop window price (here, 10,700 CHF for a Yacht-Master in the 2010s) highlighting that the analyzed models are still trading below the ~€15,000 mark in 2025, offering further appreciation potential.

Based on this methodology, eight steel “tool watch” references (with one notable exception) clearly stand out. These are essentially Rolex sports watches (Submariner, GMT-Master II, Explorer II, Sea-Dweller, Yacht-Master, Daytona) produced between the late 1980s and the late 2000s, whose value has already significantly increased since 2013 but which, in 2025, retain a high latent growth margin. Each of these watches will be analyzed below according to its technical specifications, price evolution (2013 vs 2025, estimated CAGR), and market liquidity.

The 8 Pre-Ceramic Models with High Potential in 2025

Rolex Submariner 14060M (1999-2012)

Rolex Submariner 14060M no-date (pre-ceramic, circa 2000s) – The last classic two-liner Submariner, with tritium markers until 1999 then Super-Luminova.

- Technical Sheet: Submariner “No Date” 14060M in 40mm steel, caliber 3130 (no date, derived from 3135). Black aluminum rotating bezel. Tritium “Swiss-T<25" dials until ~1999, then "Swiss" Luminova, and finally "Swiss Made" Super-Luminova. No rehaut engraving or crown on the crystal. Oyster 93150 bracelet with solid links, sometimes hollow endlinks (pre-2000) then SEL towards end of production. Drilled lugs until around 2003.

- Price 2013 vs 2025: In 2013, a 14060M could be found for around €4,000–€4,500. In 2025, its average value hovers around €8,000–€9,000 depending on condition and full set, with peaks at €10,000 for unpolished “full set” examples. This near doubling of price in 12 years corresponds to an estimated CAGR of about +6%/year.

- Liquidity: Excellent. The 14060M is highly sought after as it is the last “classic” no-date Submariner (two-line dial, no maxi-dial) and its price remains relatively contained compared to Submariner Date models. Trading volumes are high on forums and marketplaces, and a well-priced example often sells within days.

The upside potential remains high in 2025 for the 14060M. Already well-valued, it remains cheaper than its ceramic descendants (114060) while embodying the clean Submariner sought by purists. Its timeless design, balanced proportions, and historical significance (it’s the last no-date Sub produced) suggest its price could continue to rise moderately (an additional +3–5% per year is anticipated). Its highly liquid market limits risk: acquiring a 14060M today combines horological pleasure and a safe long-term investment.

Rolex Submariner Date 16610 (& 16610LV) (1988-2010)

The Submariner Date 16610 is arguably the quintessential Rolex sports model, produced for over 20 years. It even includes a highly prized anniversary version (ref. 16610LV “Kermit” with a green bezel, 2003-2010). It’s an iconic diver that, in its pre-ceramic form, offers a particularly attractive interest/price ratio in 2025.

- Technical Sheet: Submariner Date 16610 in 40mm steel, caliber 3135 (quickset date). Black aluminum bezel (green insert for the 16610LV, 50th anniversary limited series). Tritium dials until 1998 (“Swiss-T<25"), then Super-Luminova. Standard markers (on the LV: "Maxi Dial" with larger markers). Oyster ref. 93250 bracelet with SEL from ~2000, flip-lock safety clasp. Drilled lugs until ~2003, then solid.

- Price 2013 vs 2025: A standard 16610 (black bezel) traded for around €5,000–€5,500 in 2013. In 2025, it averages around €9,000–€10,000, a moderate increase (CAGR ~5%/year). However, the 16610LV “Kermit” has skyrocketed: from €6,000 in 2013, it nears €15,000 in 2025 (especially for early “Flat Four” series), reflecting a double-digit CAGR (>8%/year). The latent upside lies more in the standard black version (still affordable) than the already highly valued Kermit.

- Liquidity: Also excellent. The Sub 16610 is a pillar of the pre-owned Rolex market. Supply is plentiful, but so is demand: its attractive price compared to newer Submariners makes it a popular entry point. Examples with original papers (“punch papers”) and period accessories sell very quickly, and even models without box or papers find buyers due to the trust this well-documented model inspires.

The Submariner 16610 enjoys a solid “safe bet” image in 2025. Its price has already risen significantly, but it could still appreciate as its ceramic successors (116610, 126610) remain expensive. A more linear increase for the black versions (+4–5%/year) can be anticipated, while the Kermits, already highly priced, will follow the collector’s market trends (slower progression unless absolutely mint examples). Investing in a 16610 today remains relevant: it combines the prestige of the Submariner name, vintage charm (aluminum bezel, patina possibilities), and easy maintenance (availability of caliber 3135 parts).

Rolex GMT-Master II 16710 (1989-2007)

The Rolex GMT-Master II ref. 16710 with Pepsi bezel (blue and red) on a Jubilee bracelet – a highly sought-after pre-ceramic variant, produced from 1989 to 2007.

- Technical Sheet: GMT-Master II 16710 in 40mm steel, caliber 3185 (then cal. 3186 in later series around 2007). Bi-directional rotating bezel with iconic two-tone aluminum insert: “Pepsi” red/blue, “Coke” red/black, or all black. Red GMT hand displaying a second time zone over 24 hours. Tritium dials until 1997, then Luminova (no maxi-dial on this model). Oyster 78790 bracelet (or optional Jubilee) with hollow endlinks then SEL around 2000. Drilled lugs until about 2003.

- Price 2013 vs 2025: The GMT 16710 has more than doubled in price in 10 years. In 2013, they could be found for around €5,500–€6,000. In 2025, its average price is around €11,000–€12,000 (even more for an original full set Pepsi). Estimated CAGR ~7%/year. Notably, its current price even exceeds the list price of its ceramic successor (GMT “Pepsi” 126710BLRO) – a sign of its desirability. Pepsi versions are at the top, followed by Cokes; the black bezel is slightly less in demand.

- Liquidity: Very high. The GMT 16710 is one of the most liquid vintage Rolexes: always many buyers looking for an original Pepsi or a Coke that is unavailable today. Sales volumes are sustained, especially in Asia and the USA where GMT culture is strong. It should be noted that the presence of original accessories (e.g., punched warranty card, the two extra bezel inserts sometimes supplied by Rolex) can further increase the price and speed up the sale.

The potential of the GMT 16710 in 2025 is still considered significant because, despite the rise of new ceramic GMTs, collectors remain attached to this generation: it is the last to offer the classic aluminum Pepsi bezel, and the ease of changing inserts (switching from Pepsi to Coke, etc.) adds to its playful appeal. It is observed that the 16710s have performed better in percentage terms over the last 5 years than the first ceramic GMTs (e.g., 116710LN), a trend that could continue. It is reasonable to expect a moderate price progression of +3–4% per year for the 16710s, with perhaps an additional jump if examples in excellent condition become scarcer. Regardless, it is a model almost guaranteed not to lose value, rooted in history (originally designed for Pan Am) and in the hearts of Rolex fans.

Rolex Explorer II 16570 (1989-2011)

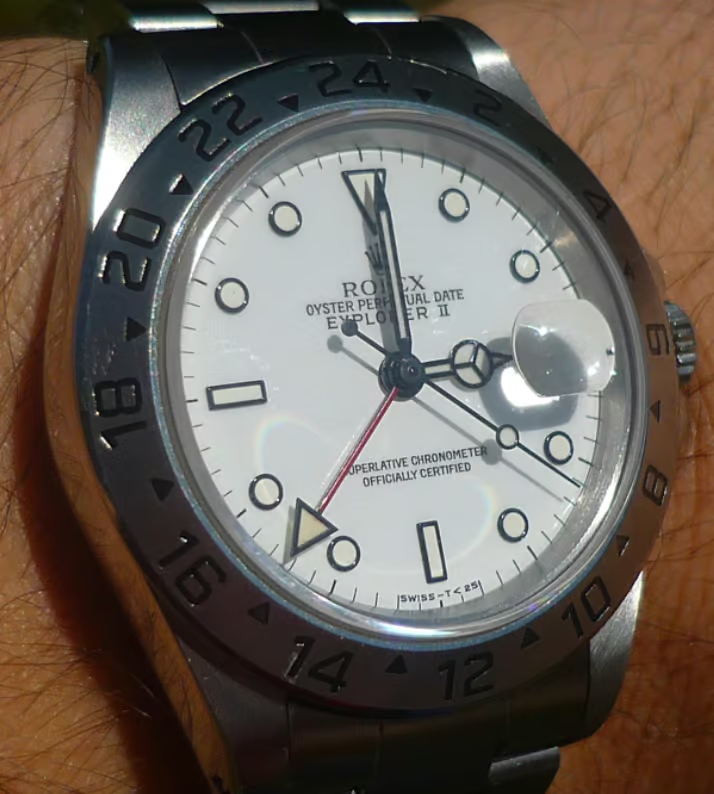

A Rolex Explorer II ref. 16570 so-called “Polar” (white dial) – a pre-ceramic model produced from 1989 to 2011, here with slightly patinated tritium markers on a 1993 example.

- Technical Sheet: Explorer II 16570 in 40mm steel, caliber 3185 then 3186 (24-hour GMT function coupled with the fixed graduated bezel). Two dial configurations: white “Polar” or black, both with lume markers. Tritium dials until ~1997 (patina possible, especially on Polars where tritium turns cream), then Super-Luminova. Classic Mercedes hands (orange 24-hour hand on Polar, red on black). Oyster 78790A bracelet with or without SEL depending on the year (SEL around 2000+). Drilled lugs until the end (even the very last “V” series in 2009 still have them).

- Price 2013 vs 2025: Long underestimated, the Explorer II 16570 was worth around €4,000 in 2013. In 2025, it trades for about €7,500–€8,000 for an average example, and up to €9,000 for a tritium Polar version with homogeneous patina (highly sought after). The CAGR exceeds +5%/year over the period. Despite this near doubling, it remains one of the cheapest Rolex sports watches, an aspect that fuels its latent margin: many consider a 16570 around €8k a bargain compared to Submariners or GMTs of the same age.

- Liquidity: Good to very good. The Explorer II was long a “niche” Rolex, but since 2020, sales have accelerated, particularly for white dial “Polar” versions favored by collectors (relative scarcity effect as black Explorer IIs sold more at the time). Tritium Polars sell very quickly as soon as they appear on specialized forums, while black dial models take slightly longer. Overall, liquidity has improved with the model’s recognition.

In 2025, the Explorer II 16570 is still undervalued relative to its potential. Its clean design, robustness (same movement as the GMT of the era), and easy daily wear appeal to a new wave of enthusiasts who couldn’t access Sub/GMTs. Its growth margin is therefore real: prices could cross the €10,000 mark within a few years, especially for full set tritium Polar examples that combine all assets. Investing in a 16570 now is betting on the revaluation of a long-overshadowed model that has all the qualities to become a future vintage Rolex “classic.”

Rolex Sea-Dweller 16600 (1988-2008)

The Sea-Dweller reference 16600 is Rolex’s ultra-resistant dive watch, often considered the “big brother” of the Submariner. Less common than the latter, it has no Cyclops lens over the date and features a helium escape valve. It is a very interesting pre-ceramic model as it was produced in relatively small numbers, giving it a certain rarity on the current market.

Rolex Sea-Dweller 16600 (1988-2008) – an iconic pre-ceramic dive model, recognizable by the absence of a date magnifier and water-resistant to 1220m.

- Technical Sheet: Sea-Dweller 16600 in 40mm steel, caliber 3135. Water-resistant to 4000 ft/1220 m (thickened case back). Helium escape valve on the case side. Black aluminum rotating bezel (identical to Sub, but graduated to 60). Tritium dials until 1998, then Luminova (Swiss Made inscription). No magnifier on the sapphire crystal (note: the date is therefore less legible, a feature of Sea-Dwellers until 2017). Oyster 93160A bracelet with dive extension, SEL after ~1999. Drilled lugs until around 2003.

- Price 2013 vs 2025: In 2013, the Sea-Dweller 16600 could be found for around €6,000–€6,500. In 2025, its average price hovers around €11,000 (€10–12k depending on condition). The CAGR is about +6%/year, similar to the Submariner Date, but with a higher absolute gain given the slightly higher starting price. A full set example from the end of production (2007-08, with engraved Rolex rehaut and Luminova) can reach €13,000 among collectors seeking the “last classic Sea-Dweller.”

- Liquidity: Quite good. The 16600 has a dedicated audience: technical dive watch enthusiasts. It generally sells a bit slower than a Submariner because its target is more specific (some are put off by the thickness or lack of Cyclops). Nevertheless, the scarcity of pre-ceramic Sea-Dwellers – and the fact that no modern Sea-Dweller is 40mm – have boosted demand. In 2025, every 16600 listed on Chrono24 quickly attracts offers, especially from connoisseurs who were waiting for “their chance” on this model.

The Sea-Dweller 16600 still presents an interesting latent margin: compared to contemporary Submariners (16610), it costs only about 10% more while being rarer and more technical. In the future, its status as the last Sea-Dweller model with “classic” dimensions (before the wider Sea-Dweller 116600 and 126600) should support a continued increase in its value. A progression of +5%/year in the coming years is conceivable. Moreover, as this model is less likely to be “overpriced” than highly publicized references, its investment appears relatively secure. For the Rolex tool watch enthusiast, the 16600 thus represents a balance between exclusivity, extreme functionality, and potential heritage valuation.

Rolex Yacht-Master 16622 (1999-2012)

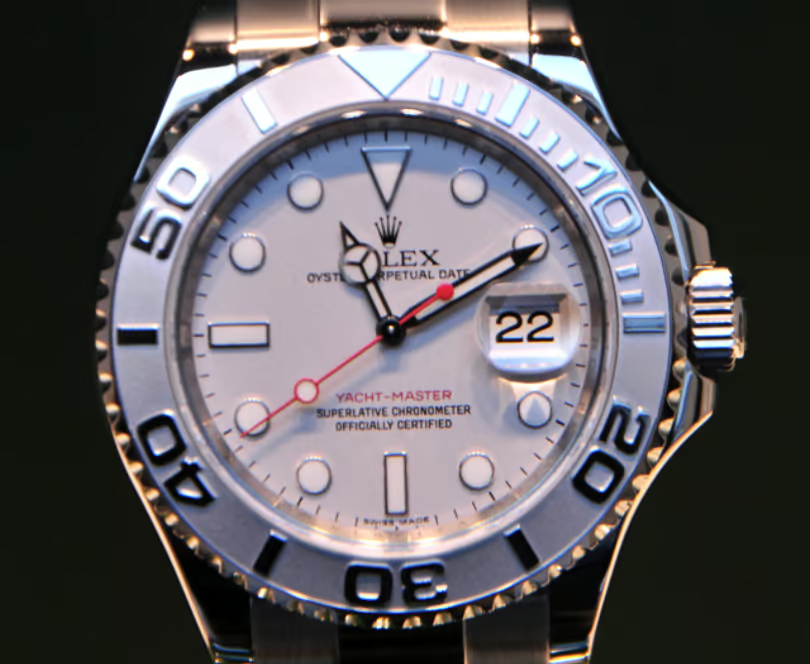

The Yacht-Master 16622, introduced in the late 1990s, is a somewhat unique model in the Rolex sports range: intended for yachting, it combines luxury and sportiness with its so-called “Rolesium” configuration (steel case and platinum bezel + dial). Long less prized than Submariners, this 40mm Yacht-Master is beginning to be rediscovered by collectors, giving it a notable growth margin in 2025.

The Yacht-Master 16622 “Rolesium” (steel and platinum) displayed in a shop window, with its platinum dial featuring red text and its matte platinum graduated bezel.

- Technical Sheet: Yacht-Master ref. 16622, 40mm steel case, bi-directional rotating bezel in solid platinum (raised graduated insert). Sandblasted platinum dial (silver-grey color) with blue or red details depending on the series (seconds hand and “Yacht-Master” text in red on early ones, then white). Caliber 3135 (date with magnifier). Super-Luminova luminescent markers from launch (1999). Oyster 78760 bracelet with solid links and SEL from the beginning, luxurious polished center links. Drilled lugs on the very first series, quickly removed (~2001).

- Price 2013 vs 2025: The Yacht-Master Rolesium suffered from second-hand depreciation; in 2013, one could be acquired for ~€6,500. In 2025, its average price is around €9,500–€10,000 – a more modest progression than other models (+4%/year approximately). However, since 2020 the trend is reversing: examples in good condition now exceed €10k, and the very first “red text” series often go for €11–12k. It remains below the symbolic €15k mark, making it potentially a relative “bargain.”

- Liquidity: Medium to good. The Yacht-Master 16622 took time to find its audience, but dynamics have changed. On marketplaces, buyers looking for a slightly different Rolex sports watch are turning to it. The volume of offers is reasonable (not an ultra-common watch), and it sometimes takes a few weeks to sell at full price. Nevertheless, complete sets (with box, anchor, papers) sell more quickly, and international demand (Singapore, Japan, Middle East) is rising for this luxurious model.

With its sophisticated look and atypical positioning, the Yacht-Master 16622 offers an still underestimated appreciation potential in 2025. It is still cheaper than the least expensive modern Submariner Date, while offering platinum and greater exclusivity (relatively low production). It can be anticipated that collectors seeking different references will continue to gradually raise its price. A moderate but steady increase (+5%/year) seems plausible, or even more if the “Rolesium” trend gains momentum. Choosing a 16622 now means betting on the return to favor of a long-spurned model, whose unique characteristics are finally being appreciated at their true value.

Rolex Cosmograph Daytona 116520 (2000-2016)

The steel Daytona 116520 is a special case in this list: it is a 6-digit model introduced in 2000, but its smooth steel bezel (non-ceramic) places it among the “pre-ceramics.” It is the first Daytona with a Rolex manufacture movement (caliber 4130), highly coveted during its production years and even more so since the advent of the ceramic Daytona in 2016. Its strong recent valuation nevertheless hides a still significant latent margin in 2025.

A Cosmograph Daytona in its pre-ceramic version (smooth metal bezel, here with a light dial). Reference 116520 (2000-2016) is the last steel Daytona before the introduction of the Cerachrom bezel.

- Technical Sheet: Cosmograph Daytona ref. 116520, 40mm steel case, Rolex caliber 4130 (integrated automatic chronograph, 72-hour power reserve). Engraved polished steel tachymeter bezel (400 scale). Dials available in black or white, Chromalight luminescent markers (blue) in later years, green Super-Luminova in early ones. Oyster bracelet with polished SEL on center links, Oysterlock clasp refined around 2015. No drilled lugs on this contemporary model.

- Price 2013 vs 2025: In 2013, the Daytona 116520 was already worth around €9,000–€10,000 (it sold above its MSRP due to waiting lists). Subsequently, it climbed spectacularly: in 2022, shortly after its replacement by the ceramic version, peaks of €25,000 were seen on the grey market. In 2025, speculative fever has calmed, and it trades around €20,000–€22,000 depending on configuration – a x2 multiplication compared to 2013 (CAGR ~6%/year, but a good part of the increase was concentrated in 2017-2021). Despite this high price, it remains lower than the current ceramic Daytona on the secondary market (a 116500LN trades for ~€28k). The latent margin therefore lies in this possibly bridgeable gap.

- Liquidity: Excellent, even frenetic. The steel Daytona is the most liquid Rolex there is – every listing instantly attracts international buyers. The 116520 is no exception: although no longer in production, demand is continuous. White dial versions are snatched up slightly faster than black ones. A notable point: service history and condition (many have been worn intensively) can influence the delay, but overall, selling a 116520 at market price usually only takes a few days, as the list of waiting buyers is long.

While the Daytona 116520 has already seen a meteoric rise, it still has future growth potential – if only because it is the last “traditional” Daytona (look identical to Zenith 16520 models but with Rolex in-house movement) and is directly compared to the current ceramic Daytona. Many collectors believe that the 116520, rarer than the new ref. 116500LN, could see its price join or even surpass that of its replacement in the medium term. Investing in a well-completed Daytona 116520 (box, papers, original links) in 2025 therefore remains a serious option, with a possibly high latent margin, especially if the gap with ceramic Daytonas narrows. However, it is an investment to consider for the long term, as the price level is already substantial and volatility is possible in case of luxury market fluctuations.

Rolex Datejust Turn-O-Graph 16264 (2001-2004)

Last in our selection and perhaps the most atypical: the Datejust Turn-O-Graph ref. 16264, sometimes nicknamed “Thunderbird.” This is a 36mm Datejust equipped with a rotating graduated bezel, reviving a Rolex concept from the 1950s updated around 2001. This watch, produced in small series in the early 2000s, was not popular for a long time, but in 2025 it is attracting the interest of collectors seeking originality – hence interesting valuation potential.

- Technical Sheet: Rolex Datejust Turn-O-Graph ref. 16264, 36mm Oystersteel case, rotating 18 ct white gold bezel graduated for 60 minutes (called Thunderbird). Caliber 3135 (Datejust). Often silver “salmon” or black dial with baton or Roman numeral markers, red seconds hand on some versions. Oyster or Jubilee bracelet seçenekleri, SEL endlinks. Water-resistant to 100m. This reference 16264 corresponds to the last Turn-O-Graphs produced before switching to numbers 116264, from approximately 2001 to 2004.

- Price 2013 vs 2025: The Turn-O-Graph 16264 traded for around €3,500–€4,000 in 2013, reflecting its relative unpopularity. In 2025, observed prices are around €6,000–€6,500 depending on condition and set. This is therefore a moderate progression (CAGR ~4%/year). However, this average hides a recent acceleration: since 2022, sales over €7,000 have been observed for examples with rare dials (e.g., “salmon” pink dial) or NOS condition. The €15k ceiling is far off, hence a strong potential margin if demand really takes off.

- Liquidity: Historically quite low, it is improving slightly. The Turn-O-Graph remains a connoisseur’s pleasure and most of the general public ignores it. It often takes several weeks to sell a 16264 at the desired price, and buyers negotiate firmly. Nevertheless, the scarcity of complete pieces (many have modified dials or are not accompanied by papers) means that true collectors are starting to grab fine examples as soon as they appear, precisely anticipating the value increase. Thus, liquidity, while not high, is on an upward trend in 2025.

The Turn-O-Graph 16264 constitutes a kind of gamble in this selection. Its mixed sport/classic design and limited production could make it a highly sought-after future “collectible,” just as it could remain a niche model. The latent margin is possibly the strongest in percentage terms, because at ~€6k it has little to lose and much to gain if its price follows that of other vintage Rolexes. Investing in this model in 2025 means anticipating a readjustment of perception: if Rolex or the community were to highlight its history (the Turn-O-Graph was the first Rolex with a rotating bezel in 1953, before the Submariner), then its value could soar. In the meantime, it is a piece that allows one to stand out, with the assurance of owning an authentic, original, and relatively rare Rolex for a still reasonable price.

International Price Comparison (2025)

The following table presents, for each analyzed model, an estimate of its average price in 2025 in several key currencies (Euro, US Dollar, Japanese Yen, Singapore Dollar). These conversions illustrate the international scope of the Rolex market and allow collectors to assess the situation in their local currency. (Rounded exchange rates as of early 2025: €1 = $1.10 = ¥145 = S$1.47).

| Rolex Model (ref.) | Average Price (EUR) | Price (USD) | Price (JPY) | Price (SGD) |

|---|---|---|---|---|

| Submariner 14060M | €9,000 | $9,900 | ¥1,305,000 | S$13,230 |

| Submariner 16610 | €10,000 | $11,000 | ¥1,450,000 | S$14,700 |

| GMT-Master II 16710 | €12,000 | $13,200 | ¥1,740,000 | S$17,640 |

| Explorer II 16570 | €8,000 | $8,800 | ¥1,160,000 | S$11,760 |

| Sea-Dweller 16600 | €11,000 | $12,100 | ¥1,595,000 | S$16,170 |

| Yacht-Master 16622 | €10,000 | $11,000 | ¥1,450,000 | S$14,700 |

| Daytona 116520 | €22,000 | $24,200 | ¥3,190,000 | S$32,340 |

| Turn-O-Graph 16264 | €6,500 | $7,150 | ¥942,500 | S$9,555 |

NB: These prices are estimated averages and may vary depending on condition, the presence of complete accessories (box & papers), and the specifics of each example (specific series, dial variations, etc.). However, they provide an order of magnitude for prices in 2025 on major international markets.

Comparative Performance Against Ceramic Models

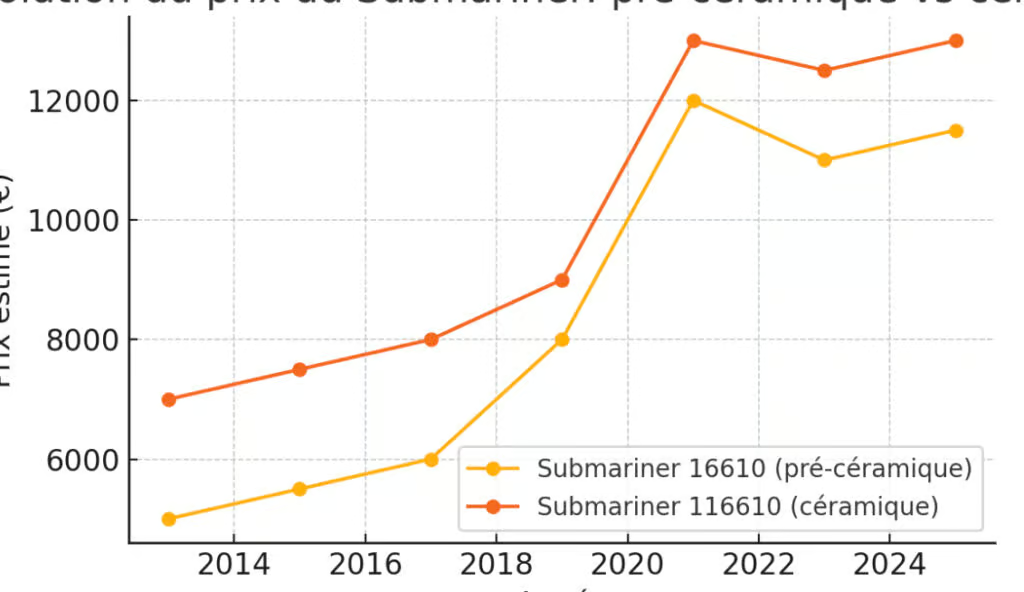

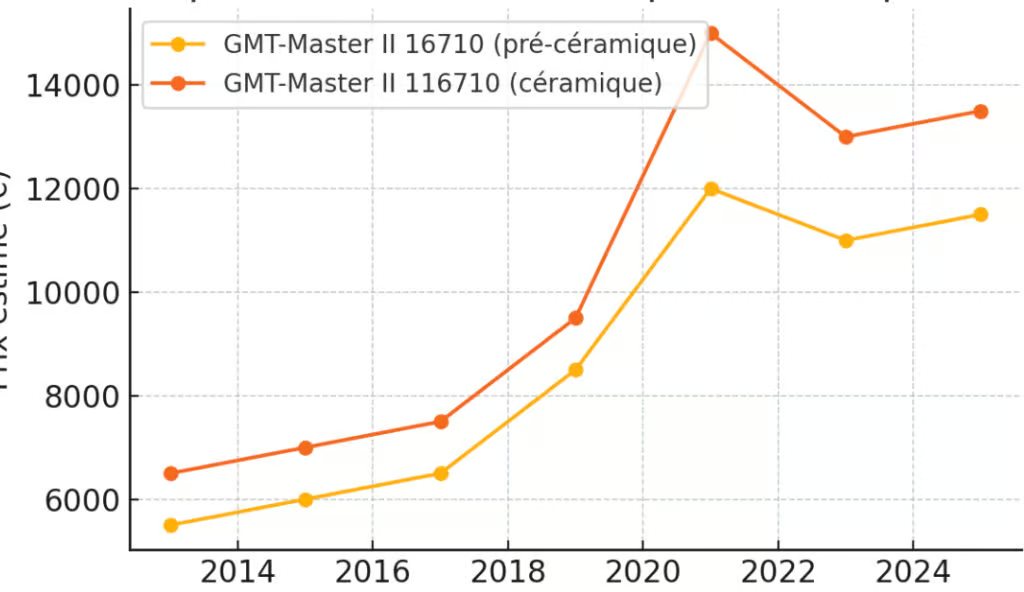

It is instructive to compare the value evolution of some pre-ceramic models with that of their ceramic counterparts released shortly after, to visualize the difference in trajectory. The graphs below show, for example, the case of the pre-ceramic Submariner Date 16610 versus the ceramic Submariner Date 116610, then the GMT-Master II 16710 versus the ceramic GMT-Master II 116710 (LN or BLNR).

Price evolution of the pre-ceramic Submariner Date (16610, yellow curve) compared to the ceramic Submariner Date (116610, orange curve). It is observed that the pre-ceramic model appreciated sharply after 2018 and tends to reduce the gap with the ceramic model.

Price evolution of the GMT-Master II 16710 (pre-ceramic, yellow curve) vs GMT-Master II 116710 (ceramic, orange curve). The curve for the pre-ceramic model shows a pronounced rise in 2019-2021 and superior resilience, illustrating its collector appeal.

In both cases, several trends emerge:

- Pre-ceramic models saw their price grow faster in % terms than ceramic models after around 2017. This coincides with the vintage boom and the arrival of new Rolex releases (new calibers, new dimensions) which pushed enthusiasts of classic formats to the secondary market.

- Both the Submariner 16610 and the GMT 16710 have almost reached parity in absolute value with their ceramic successors, whereas they were worth much less originally. For example, in 2013 a Sub 16610 was worth ~70% of the price of a new Sub 116610, while in 2025 it is worth almost 90%. The same applies to the GMT Pepsi 16710 vs the GMT LN 116710.

- Market correction phases (e.g., slight dip in 2022) affected both generations, but more markedly on highly speculative ceramic models. Pre-ceramics, on the other hand, show better resilience after these corrections, a sign that they are more often held by long-term collectors than by speculators.

These comparisons confirm the thesis that in 2025, pre-ceramic Rolex sports watches often offer a better historical return and lower risk than more recent models. Of course, each reference has its specificities, but the general trend suggests that demand for reliable “neo-vintage” watches with classic charm should continue to support their value increase, potentially to the same level – or even beyond – that of equivalent ceramic references.

🔎 Key Criteria for Pre-Ceramic Models to Know

When looking for a pre-ceramic Rolex, here are some decisive criteria that can strongly influence value:

- “Flat Four”: refers to the bezel of the first series Submariner 16610LV Kermit (2003) where the number 4 in “40” is flat at the top. This rare variant is highly prized (several thousand € more than a standard bezel). Visually identifiable on the insert.

- “Pepsi” Insert: for GMT-Master II 16710s, the two-tone red/blue bezel known as Pepsi is the most sought after (symbol of vintage GMTs). Since the same 16710 can accommodate Pepsi, Coke, or black inserts, having the original intact insert adds value.

- SEL (Solid End Links): early Oyster bracelets from the 90s had hollow end links. From ~2000, Rolex introduced SELs, which are more robust. Generally, the same reference with SEL (end of production) will be worth slightly more than one with hollow end links.

- Drilled Lugs: the presence of through-holes on the case lugs (until the early 2000s) is a true “tool watch” marker. Some collectors prefer with, others without, depending on authenticity vs. aesthetics. For two identical watches, those with drilled lugs tend to become more sought after as they are rarer on late series.

- “Punch Papers”: watches sold before ~2006 had cardboard paper warranty certificates with the serial number machine-stamped (hence “punched”). Having these original papers significantly increases value (up to +15%). Modern plastic cards have less impact on the price of recent pieces, but for vintage, old Rolex papers are highly prized.

Other elements such as the type of luminova (Tritium vs Super-LumiNova), the presence or absence of rehaut engraving, the condition of the bezel (faded or “tropical” on some aluminum inserts) can also affect value. Knowing these details well will help you find the most promising examples in terms of potential added value.

:contentReference[oaicite:10]{index=10}

On the left, the Submariner 16610LV “Kermit” with its highly coveted “Flat Four” green bezel (4 with a flat top); on the right, the GMT-Master II 16710 “Pepsi” red/blue. These two details (Flat Four and Pepsi insert) are among the sought-after criteria that increase the value of pre-ceramic Rolexes.

Purchase and Authentication Checklist

Before finalizing the purchase of a pre-ceramic Rolex, it is essential to perform a few checks to ensure the conformity and authenticity of the piece. Here is a concise checklist to follow:

- ✅ Serial and Model Number: Verify that the numbers engraved between the lugs match those on the papers (if available). A number discrepancy or unclear engraving should be a red flag.

- ✅ Original Dial and Hands: Ensure the dial corresponds to the year (e.g., “Swiss-T<25" for tritium before 1998, "Swiss" alone in 1999, etc.). Beware of "service" dials replaced during maintenance, which can decrease value for collectors.

- ✅ Bezel and Insert: On models with aluminum inserts, inspect the insert: if it looks too new compared to the overall condition, it may have been replaced. An original insert with slight, uniform discoloration is preferable. On a 16610LV, identify if the bezel is indeed a Flat Four if advertised as such.

- ✅ Bracelet: Count the number of links (should correspond to the original full set, often 13 links for a sports Oyster). Check the stamped reference and the presence of correct endlinks (numbering underneath). A period bracelet in good condition, even with some stretch, is a plus.

- ✅ Case Condition: Look at the chamfers and edges: are they still present or worn down by excessive polishing? An over-polished case loses value. The presence of clean drilled lugs (if applicable) is a good sign.

- ✅ Movement Operation: Test the watch’s running, timekeeping, and power reserve. On GMT/Explorer II models, try the 24-hour function. A recent service certificate from Rolex or a qualified watchmaker is a significant plus.

- ✅ Papers and Accessories: Ideally, opt for an example with its period box, pouch, and especially its original warranty (“punched” or card). “Full sets” resell better and will continue to appreciate more in value.

- ✅ Authenticity: If in doubt, have the watch checked by a Rolex watchmaker. Compare each part (dial, bezel, bracelet) with official databases or catalogs. Beware of composite watches (Frankenwatches) mixing parts from different eras.

Counterfeit “Rolex” watches seized in Taiwan (1988) – a reminder that authentication is crucial. As pre-ceramics are older, it is best to examine all details (engravings, text font, movement finish) to avoid unpleasant surprises.

By following this checklist, you will maximize your chances of acquiring an authentic pre-ceramic Rolex, in its most original configuration and with the best long-term appreciation potential. Remember that in this market of enthusiasts, patience and knowledge are your best assets: the right deal comes to those who know how to wait for it and recognize it. Happy hunting for the vintage Rolex of your dreams!